Community Group Buying (CGB) is considered the last large consumer battleground in China Tech. Many heavy weights (e.g. Pinduoduo, Meituan, and Didi) are coming into this market and competing. What does CGB mean exactly?

CGB stands for group purchase and delivery of groceries in bulk to the community, mainly people who live in the same neighborhood. Grocery delivery. That’s it? Are these big tech companies nuts?

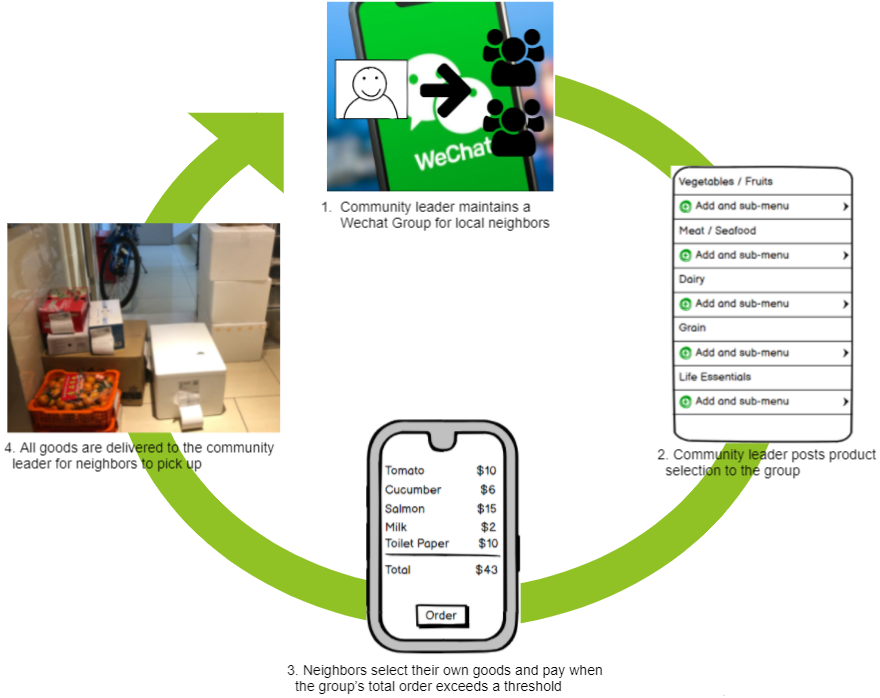

How CGB works

According to Lillian Li who writes a newsletter on China Tech called “Chinese Characteristics”, online grocery 1.0 in China is challenged by two factors: attracting users, and first/last mile delivery that eats into the margin. COVID expedited the growth of grocery eCommerce, specifically in the rural area of China. China is largely divided into 2 parts: the developed part which is often referred to as the first-tier cities i.e. Beijing, Shanghai etc, and the developing part which is referred to as the second-tier cities i.e. Changsha.

The second-tier cities consist of 1 billion people, 10% GDP growth per capita, and historically a green field for big tech. This group usually is more price-sensitive and less time-sensitive than their peers who live in first-tier cities. Since COVID limits people’s movement outside of their apartment, and the CGB business model reduces last-mile delivery cost by grouping the community’s order together, it makes sense for people in rural China to become users of CGB. As such, the battle to acquire these 1 billion users is hotter than ever.

Now that we understand how CGB works in China, I wonder: can this business model be successful in the US?

China vs. US demographic comparison

| China | US | |

| Population | 1.4B1 | 330M1 |

| Average population / city | Tier 1 / 2 city: 10M2Rural area: 1M2 | Metro area: 1M3Suburban area: 200K3 |

| GDP growth per capita | 5.6%4 | 1.7%4 |

| Current & Future grocery market size | $1.4T / $1.8T5 | $1.5T / $1.7T5 |

| Current & Futureonline penetration | 10% / 50%6 | 4% / 22%7 |

- Sources: World Bank, United States Census Bureau

- Source: https://en.wikipedia.org/wiki/List_of_cities_in_China_by_population

- Source: https://en.wikipedia.org/wiki/List_of_United_States_cities_by_population

- Souce: https://data.worldbank.org/indicator/NY.GDP.PCAP.KD.ZG

- Source:https://www.igd.com/articles/article-viewer/t/global-grocery-markets-forecast-to-create-19-trillion-opportunity-by-2023/i/20842

- Source: McKinsey China consumer report

- Source: https://www.winsightgrocerybusiness.com/retailers/new-data-pegs-online-grocery-penetration-soaring-past-20

China has the competitive advantage of having a high urban density, and online grocery market penetration has already crossed the Chasm, with about 15% of consumers having adopted this business model. But what could be the future of CGB in the US? I did some research with the help of Paul Lang, the founder of a NY-based CGB, YunBanBao (YBB).

Like many entrepreneurs powered by WeChat buying groups, YBB started their business on WeChat in 2015 to solve the need of Chinese workers who crave authentic Chinese food during lunchtime while working in different business areas in Manhattan. YBB connects these individuals with restaurants in Flushing, Queens, the largest Chinatown in NYC. When COVID started, 90% of YBB’s business vanished, leading them to quickly pivot to grocery delivery in addition to food delivery, providing more choices for the same order. Their grocery delivery mainly focuses on exotic fruit and seafood that most Chinese love and need while working from home.

The challenges Community Group Buying faces in the US

There is a market for CGB in the US especially post the pandemic as we witnessed the growth of several grocery delivery platforms such as i.e. FreshDirect. However, Community Group Buying (CBG) faces several challenges in the American Market:

- Consumer behavior and community is defined differently in America. Americans, especially the ones who live in the urban area usually are picky, demanding, and require a near frictionless experience in order to try out CGB and potentially become repeat customers.

- The supermarket network is very robust. In each town, there is usually a Walmart, ShopRite or Stop & Shop within a 15-minute drive. The quality of their goods isn’t outstanding, but it’s sufficient. They are very reasonably priced and the store is convenient.

- Americans’ food preference is relatively simpler. A typical Chinese meal is dishes of veggies, fish and meat accompanied by rice and soup. Whereas a typical American meal is a main entree of protein with side dishes of salad and carb. People usually won’t spend a lot of time cooking big meals every day. They usually do grocery shopping once a week to take care of basic needs.

Online grocery is not a pain point for the majority of Americans. Therefore, I don’t think CGB will become a replacement for traditional grocery shopping, but rather an alternative channel to purchase exotic, high-quality goods that are not typically seen at your local supermarkets.

The secret paths to success

High quality, reasonably priced goods and delivery convenience are the secret paths to success as a CGB platform. Among these factors, quality is the most important to build a brand name that is sustainable in the long run. What does this mean? We buy groceries to take care of our basic needs. Sometimes we try interesting stuff when we see it. We won’t shop at places that consistently don’t cover our basic needs. In a similar vein, we expect the products we bought to be good because we usually don’t expect to return groceries.

Therefore, Supermarket chains that traditionally carry high-quality goods i.e. Costco, Whole Foods, etc. could be winners in the CGB space because the first mile and sourcing of high-quality goods are the keys to making CGB work. Developing online ordering and last-mile delivery are just additions to the end-to-end CGB supply chain, they are not the driving factors for consumers to determine which platform to go to.

The Takeaways

- Community Group Buying is a harder problem to solve in the US than in China. Online grocery is not a pain point for the majority of Americans. Therefore, CGB is an alternative channel to traditional grocery shopping rather than a replacement. However, as more and more companies continue to invest in it, it will ultimately take off.

- The secret sauce to win this market is to figure out first-mile delivery, sourcing of high quality goods. Quality is the most important factor to build a sustainable brand. Online ordering and last-mile delivery are just add-ons. Therefore, supermarket chains that traditionally carry high quality products i.e. Costco, Whole Foods etc. could be winners of CGB.

- What’s next for CGB in the US?

- Understand the community. Community does not necessarily have to be people who live in the same town. It can be broadly defined as people who have similar interests e.g. YBB serves people who love Chinese food. Existing community based social media such as Facebook groups, Nextdoor can potentially be leveraged for CGB last-mile delivery.

- Establish the supply chain and services mechanism. It’s hard to win based on services alone. The supply chain is the bread and butter of the overall success of CGB. Traditional supermarket giants may seem to have advantage in this area. However, other business models i.e. community supported agriculture (CSA) can be modified to meet the demand and scale that CGB requires.

The online grocery market is so young, and it’s too early to tell who will be the ultimate winner. There will definitely be more investments and innovations happening in this space, I look forward to seeing what’s next.